2 Data exchange in the real estate sector

2.1 Data exchange processes

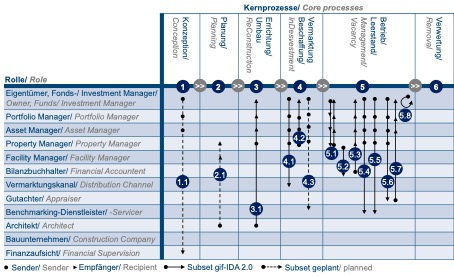

A wide range of core processes are associated with the life-cycle of a property. The individual processes are divided into nine life-cycle phases or core processes in GEFMA Guideline 100-1. A large amount of information is exchanged between changing specialist service-providers and owners, from conception of a property or investment vehicle (1), through planning (2), construction and subsequent refurbishment of a property (3 and 7), marketing and procurement (4 and 5), ongoing operation, incl. any vacancies (6 and 8), to utilization (9). The questions and answers therefore always depend on the objectives and tasks of the parties asking and answering the questions. For all communication processes to run successfully, it is largely dependent on whether the parties involved are in agreement about the content and qualities to be supplied. The exchange of information between the actors is therefore closely linked to the reason for the exchange or task to be performed by the actors. The objectives associated with the processes define the content and methods of the data exchange. This guideline is based consistently on the life-cycle phase in accordance with GEFMA Guideline 100-1, which is divided into six core processes (conception, planning, construction, marketing and procurement, operation and vacancy, and utilization) involved in the real estate sector as shown in Fig. 2.

When defining subsets in this version 1.0 of the guideline, gif focused on the main core processes of Purchase, Management, and Sale of properties, in accordance with Tab. 1.

Subsets 5.5 Benchmarking of operating costs, 5.6 Basic data for preparing expert reports, and 5.7 Valuation reports were newly included in version 1.1. In version 2.0, subset 5.8 Target fund to fund of funds was added. In version 3.0, subset 5.4 “Portfolio management” was replaced with “ESG basic data”. The guideline will be continuously updated and have further subsets added to it.

| No. | Processes and subsets |

|---|---|

| 1 | Conception |

| 2 | Planning |

| 3 | Construction, refurbishment |

| 3.1 | Reporting on construction projects |

| 4 | Investment/Desinvestment |

| 4.1 | Provision to sales channel |

| 4.2 | Commercial due diligence |

| 4.3 | Lease benchmarking |

| 5 | Operations and vacancies |

| 5.1 | Ongoing operational reporting |

| 5.2 | Ongoing accounting reporting |

| 5.3 | Ongoing financial accounting reporting |

| 5.4 | ESG basic data |

| 6. | Removal |

2.2 Roles and role model

A role in the process model according to gif-IDA is a function that a sender or recipient assumes within the core process. The allocation of roles among the actors is a changing variable in the various processes. In this respect, nearly all actors take on different roles in the course of the property life-cycle. For instance, a company purchasing a property may assume the role of buyer as a recipient, whereas when selling the same property, they may act as sender. Within the guideline, the following roles were identified as relevant for the exchange of real estate data in accordance with Fig. 4:

- Owner, Fund/ Investment Manager

- Portfolio Manager

- Asset Manager

- Property Manager

- Facility Manager

- Financial accountant

- Sales channel

- Valuer

- Benchmarking service-provider

- Architect

- Building contractor

- Financial supervisory authority

- Tenant

This traditional role model can also be applied to service capital investment companies (German: Service-KAGs). The capital investment company can take over the role of an Owner and an Asset Manager.

As all actors generally assume changing roles, in other words they sometimes act as recipients and sometimes as senders, it must be possible to process as well as provide process-based data depending on the respective business model of all actors. The above role model is thus built on the basis of gif guideline on Real Estate Investment Management (REIM).

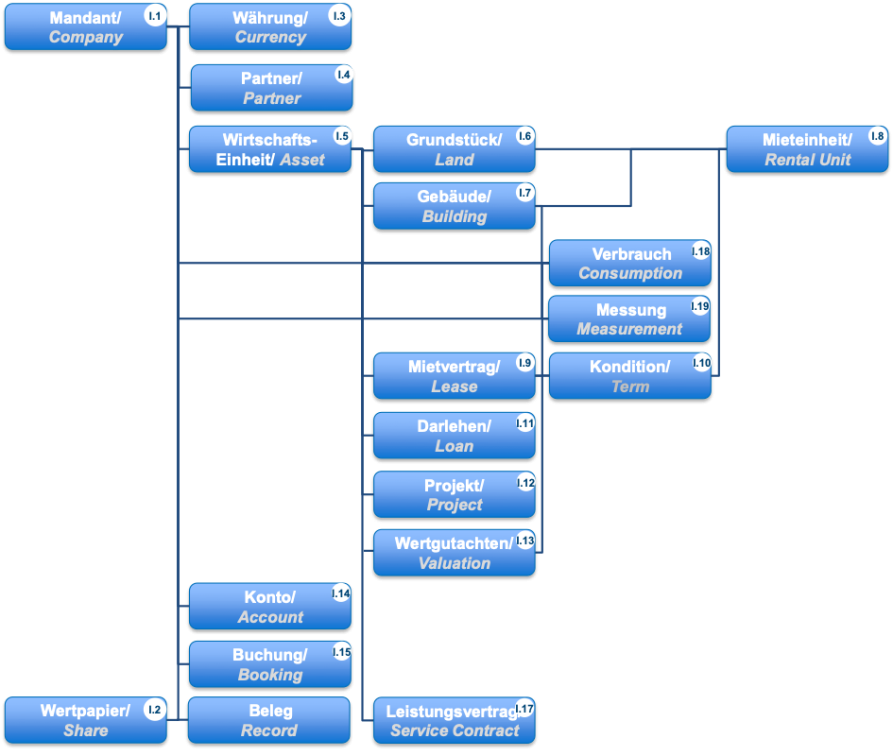

2.3 Data model and entities (data objects)

The guideline is based on a hierarchically built real estate data model. The real estate character is particularly apparent in the allocation of the data fields to the entities (also referred to as data objects). Each data field of a subset is clearly matched to an entity. For example, the data field land area is uniquely allocated to the entity land. Each subset is allocated the required entities in each case. As shown in Fig. 5, a total of 17 data objects can be identified.

- I.1 Company (COM): The client or company is the first legal level of a sub-fund of the data to be transmitted. Each client can be allocated the appropriate company form (e.g., investment company, partnership, fund, stock corporation, consolidation). In combination with the Connection table (see section 4.4.1), which defines the hierarchical relations between the clients, the data exchange can relate to complex asset structures.

- Example: ABC GmbH

- I.2 Securities (SHARES): If the data exchange not only relates to the real estate asset class (e.g., subset 5.8), this entity can be used to include information on a client'’s investments in securities.

- Example: Sample stock ABC ISIN DE1234567

- I.3 Currency (CUR): The currency entity comprises information on a client'’s assets in the currency area, the extent of hedging the currency in question, and the translation rates used in each case.

- Example: SEK (more detailed information on exchange rate, assets in currency area, and hedging ratio of currency forwards)

- I.4 Contracting party (PAT): The contracting party entity can be used across clients. In relation to the contracting party, address data and role information is stored. The appropriate contracting party ID can be allocated to each contractual arrangement, especially lease agreements. Among other things, this allows the inclusion of cross-client contractual arrangements for identical legal persons as well as different contracting party roles in data exchange.

Example: ABC GmbH - I.5 Property (PROP): The property entity combines a number of substantively connected assets. It incorporates one or more plots of land and/or one or more buildings. The property generally comprises an asset number, country, postcode, city, and street, including house number. If an asset incorporates a number of buildings with different addresses (e.g., City Square), and the corresponding ERP system requires a main address to be specified, the primary address for the asset must be entered.

- Example: 1200, Deutschland, 12345 Musterstraße 45, Müllerstraße 10-14

- I.6 Land (LAND): In German property law, land is described as a discrete part of the Earth'’s surface that is entered on a separate page in the land register (section 3 of the GBO (German Land Registration Act)). Land can consist of several land parcels.

- I.7 Building (BUILD): A building is an enclosed space comprising individual or several rooms and stories. Buildings within an asset are numbered consecutively. A building may comprise a separate street, postcode, and city.

- Example: Building 17 or Müllerstraße 12

- I.8 Rental unit (UNIT): The rental unit is the smallest leasable unit. A rental unit is generally characterized by a rental unit no., various types of space (e.g., leasable space based on measurements, service charge billing area, heating costs billing area), type of use, story, and location.

- Example: 12345676 Office, 2nd story li

- I.9 Lease contract (LEASE): The lease contract interconnects one or more contractually leased rental units. A lease contract generally comprises the lease contract number and the name of the tenant. Example: 233-12223-22344; ABC GmbH

- I.10 Term (TERM): The term entity represents current and future contract terms and conditions (e.g., basic rent, escalation clauses, rent concessions) in relation to a rental unit. It connects the lease contract to a rental unit. In the term entity, a distinction is made between different types of term (e.g., basic rent, revenue-based rent, service charge prepayment, value added tax, etc.). Example: Office 2nd story, ABC GmbH

- I.11 Loan (LOAN): A loan is a promissory contract. The loan entity generally comprises the loan no. and lender.

- Example: 1234 Musterbank GmbH

- I.12 Project (PROJ): A project is a specific one-off operation, with a defined start and end date. A project within the data model according to gif-IDA comprises a project no. and brief description of the project.

Example: 1234 façade renovation - I.13 Valuation (VAL): The valuation entity is used for exchanging the determined expert report, incl. underlying data, on a specific date. The expert report number and brief description form part of the valuation.

- Example: 12356 expert report Q1 2012

- I.14 Account (ACC): The account or account balance entity represents the total of all book entries performed in a financial accounting account within a book entry period. An account balance comprises individual book entries. An account balance comprises the amount entered, the corresponding currency, and a code to indicate whether it is a debit or credit.

- Example: EUR 456.78

- I.15 Book entry (BOOK): Each book entry is a transaction on the account. A book entry comprises the amounts (net, gross, etc.) and corresponding currency. More than one record may exist for one book entry.

- Example: EUR 632.95

- I.16 Record (REC): The book entry record may incorporate several book entries. Several book entry records in a financial accounting account within a book entry period will generate a book entry balance. A book entry record comprises the amount entered and corresponding currency.

- Example: EUR 678.90

- I.17 Service contract (CON): A service contract is a contractual agreement to which a creditor, service (e.g., maintenance of elevator systems), and service contract number are assigned.

Example: 1234-13 Muster FM GmbH maintenance elevators - I.18 Consumption (CONSUMP): The consumption entity is one of the two entities on resource consumption (e.g., consumption of electricity, gas, waste) used for the ESG data acquisition. Consumption can be recorded at entity level I.1 Client (or company), I.5 Asset, I.7 Building and I.7 Lease (see Fig. 5). The consumption can be recorded via a meter or manually.

- I.19 Measurement (MEAS): The measurement entity is the second resource consumption entity used for the ESG data acquisition. In the same way as the I.19 Consumption entity, measurements can also be recorded at entity level I.1 Client (or company), I.5 Asset, I.7 Building and I.7 Lease (see Fig. 5). The measurement entity is the level at which resource consumption is actually measured e.g., in the form of a visual meter reading, a measurement document or a consumption bill or estimate.

- The position of an entity in the data model is defined by the hierarchical relationship between the various entities. For example, a building is only assigned to one property. As shown in Fig. 5, the hierarchical relationships between the various entities (also referred to as data objects) are as follows: